GPS Tracking Devices in Car Finance Leasing

Against the backdrop of a rapidly growing global automotive finance and leasing industry, GPS tracking technology is becoming a core tool for risk management and asset protection. As cross-border leasing business increases and default risk rises, traditional collateralised security models are no longer able to meet the industry’s needs, and intelligent location solutions are reshaping the landscape of this multi-billion dollar industry.

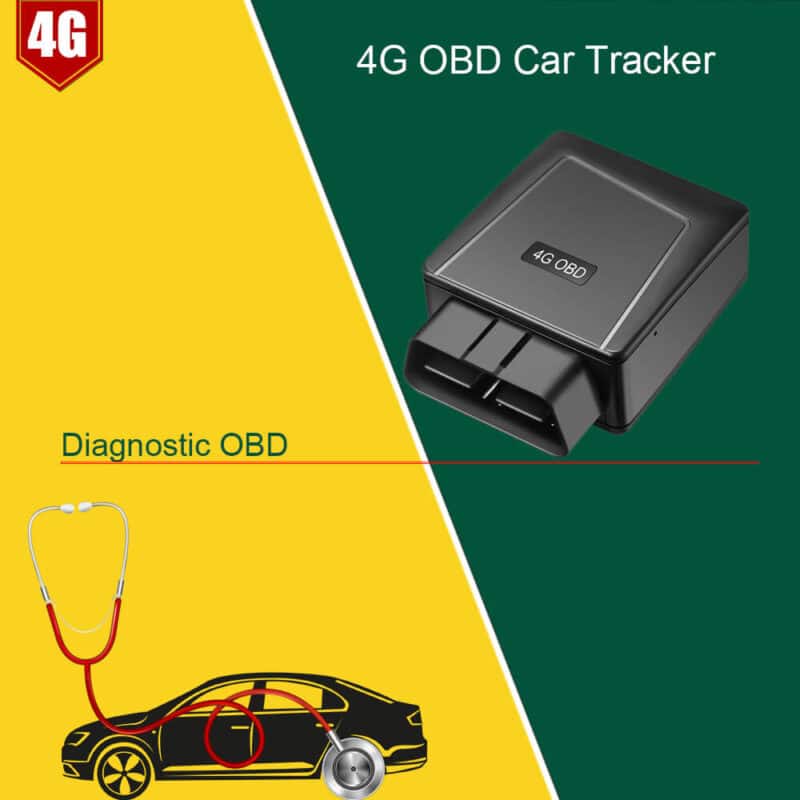

The Role of GPS Tracking Devices in Car Financial Leasing